The following analysis of the Salt Lake County real estate market is provided by Windermere Real Estate Principal Economist Jeff Tucker. We hope that this information may assist you with making better-informed real estate decisions.

ECONOMIC OVERVIEW

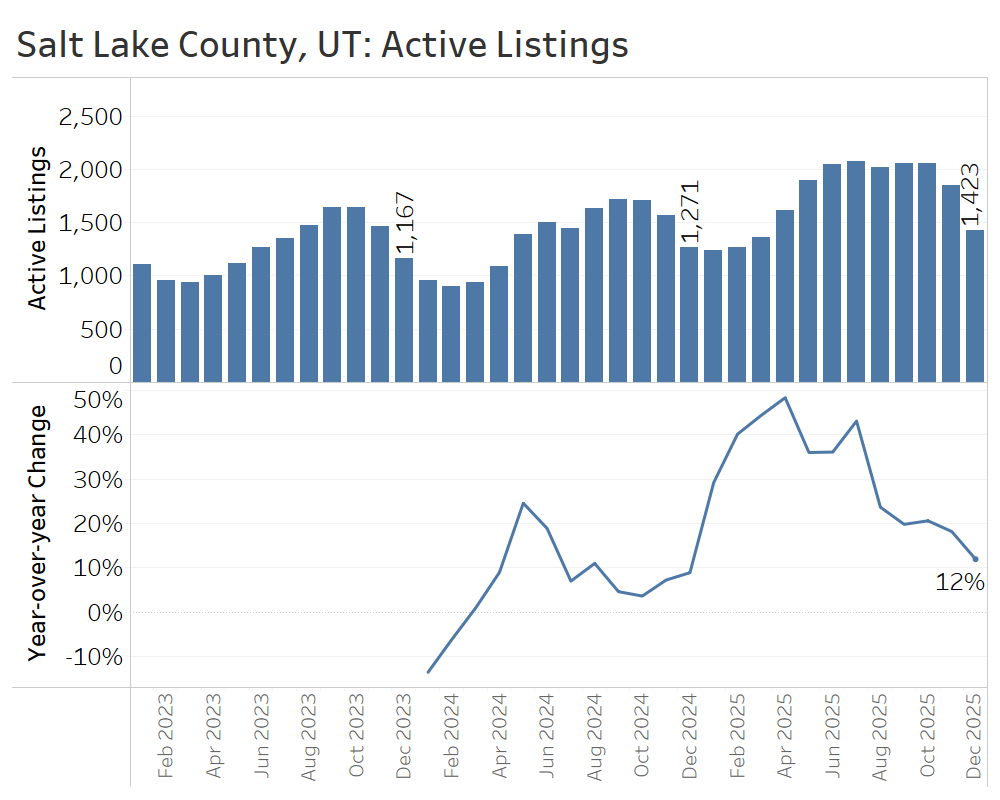

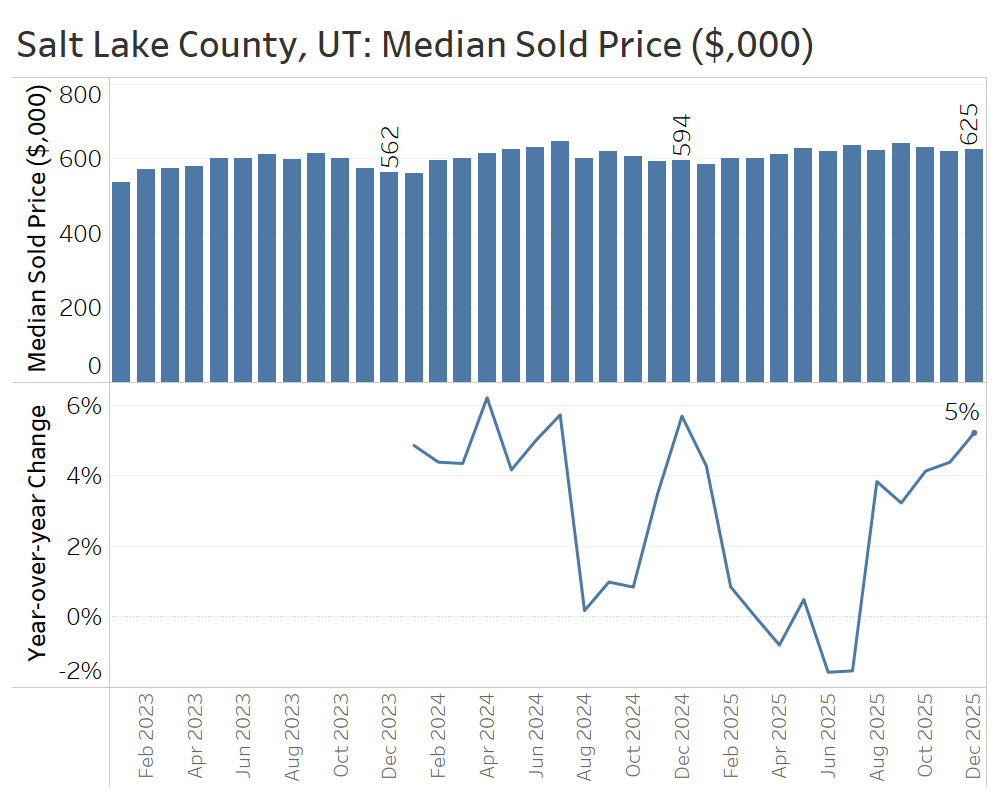

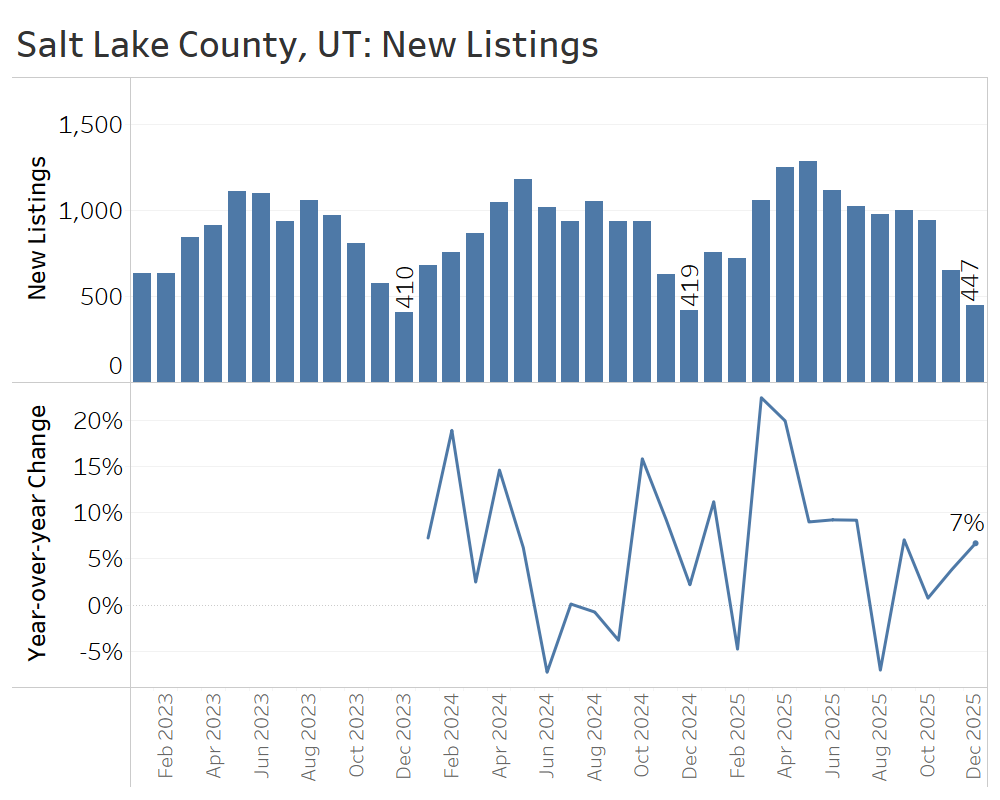

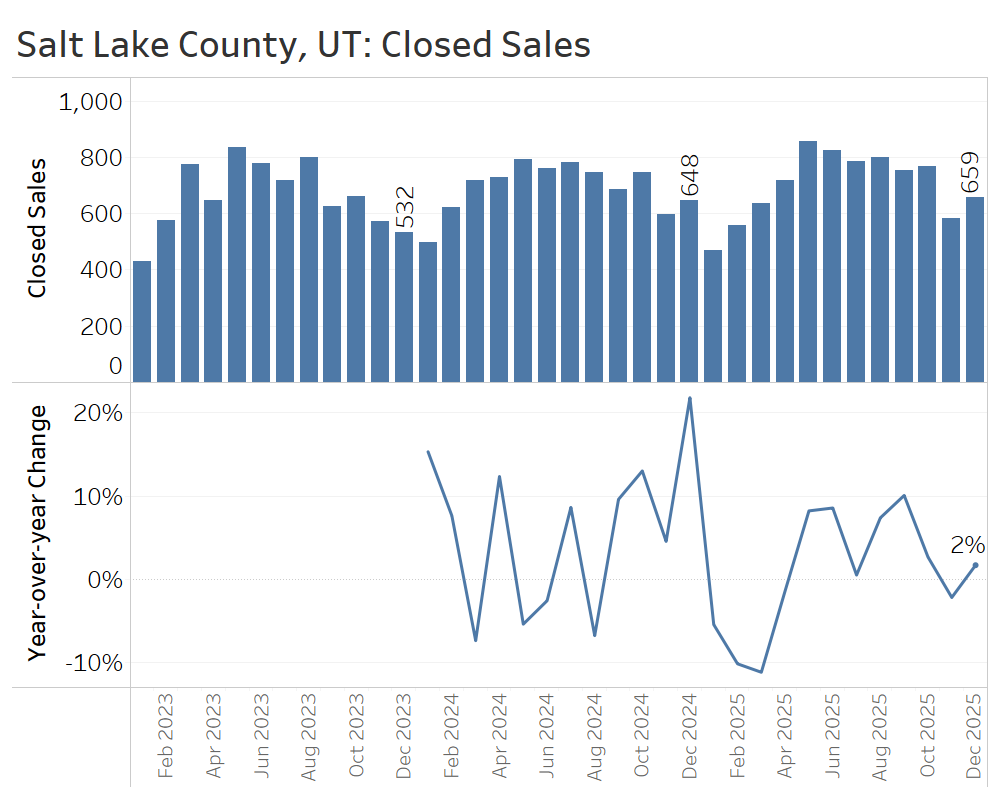

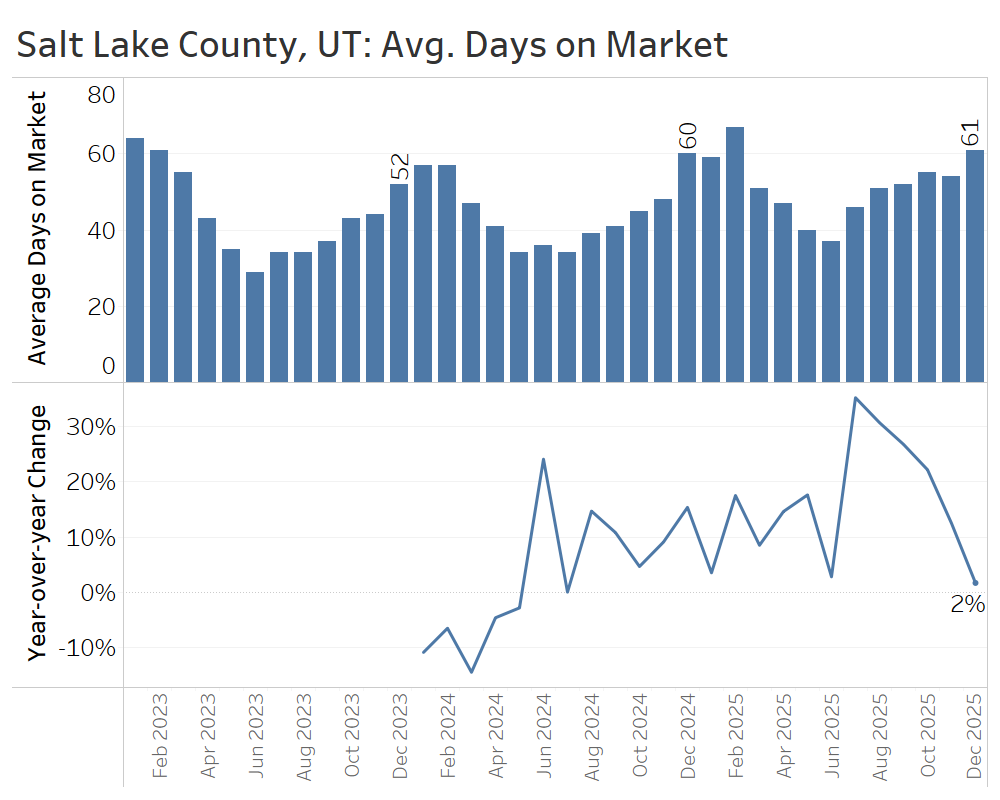

Market conditions in Salt Lake County swung sharply in buyers’ favor early in 2025, as rapid inventory growth led to modest price declines. More recently, however, the market has begun to look more balanced rather than distinctly a buyer’s market.

All in all, Salt Lake County has shifted into a more balanced market, driven by modest price growth and a slowdown from the significant inventory buildup seen earlier in 2025.

CONCLUSIONS

All of the markets covered in this report shifted in buyers’ favor in 2025, though some, like Salt Lake County, show that the pendulum can—and will—begin to swing back toward more balanced conditions.

Going forward, buyers should be aware that in most markets, there are more listings than in recent years, home prices have remained roughly flat for at least a year, and mortgage rates are near three-year lows. Together, these factors create a strong opportunity to buy. That said, buyers should also be mindful of the usual spring surge in competition, which will accelerate home sales and push prices higher, as it does every year. Savvy buyers can try to get ahead by shopping earlier, but they should also be prepared to write a competitive offer if their ideal home hits the market this spring.

For sellers, the peak selling season is fast approaching. But even in a more balanced market, homes do not sell themselves. The best outcomes still depend on presenting the home well, setting the right list price, and marketing effectively to the right buyers. With the right strategy, this spring presents a great opportunity to sell for the best possible price, especially as lower mortgage rates bring more buyers off the fence.

Sources: TrendGraphix analysis of NWMLS, RMLS, Spokane MLS, MetroList MLS, and Wasatch Front MLS data.

About Jeff Tucker

As Principal Economist for Windermere Real Estate, Jeff Tucker is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Jeff has over 10 years of experience as an economist at companies such as Zillow, Amazon, and AirDNA.